|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Low Credit Home Loans: Understanding Your Options and BenefitsSecuring a home loan with low credit can be challenging, but it's not impossible. By exploring the best low credit home loans, you can find a path to homeownership even if your credit score isn't perfect. This guide will help you understand the main benefits and common mistakes to avoid. Types of Low Credit Home LoansSeveral loan options are available for individuals with low credit scores. Understanding these can help you make an informed decision. FHA LoansFHA loans are a popular choice for borrowers with lower credit scores. These loans are backed by the Federal Housing Administration and typically have more lenient credit requirements.

VA LoansAvailable to veterans and active-duty service members, VA loans offer significant benefits for those who qualify.

Benefits of Low Credit Home LoansDespite the challenges, low credit home loans come with several advantages.

Common Mistakes to AvoidWhen applying for a low credit home loan, it's essential to avoid certain pitfalls. Overlooking Additional CostsMany borrowers focus only on the down payment and monthly mortgage payments, neglecting other costs.

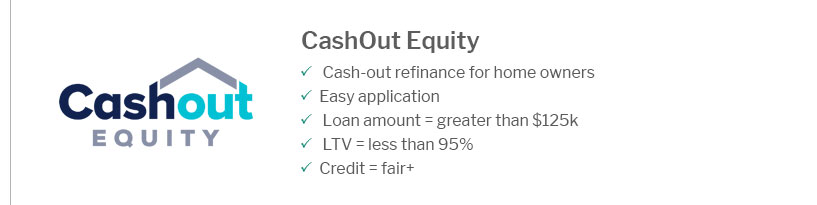

Not Comparing LendersEach lender offers different terms and rates, so shopping around is crucial. Use resources and home buying programs to compare offers and find the best fit for your situation. FAQ SectionWhat credit score is needed for an FHA loan?The minimum credit score for an FHA loan is typically 500, but a score of 580 is required to qualify for the 3.5% down payment option. Can I get a home loan with a credit score of 550?Yes, you can qualify for certain types of loans, such as FHA loans, with a credit score of 550, though you may need to make a larger down payment. Are there any grants available for first-time homebuyers with low credit?Yes, several grants and assistance programs are available for first-time homebuyers, which can be particularly beneficial if you have low credit. https://www.chase.com/personal/mortgage/education/financing-a-home/home-loans-with-low-credit

FHA loan. 580 (or 500 with a minimum 10% down payment) ; VA loan. There is no official minimum credit score for VA loans, but most mortgage lenders require a ... https://www.lendingtree.com/home/mortgage/bad-credit-home-loans/

Bad credit mortgage lenders: Lender options for bad credit home loans ; Carrington Mortgage Services, Low credit FHA loans. Low credit VA loans, 500 (FHA and VA ... https://www.alpinebanker.com/imperfect-credit

The Federal Housing Administration (FHA) insures FHA loans for consumers with poor credit, providing a safety net that allows lenders to offer mortgage loans ...

|

|---|